how are annuities taxed to beneficiaries

Different tax consequences exist for spouse versus non-spouse beneficiaries. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of.

Until you receive your annuity distributions or stream of income taxes are deferred.

. Depending on. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. Designating Others When you specify someone else as your beneficiary such as a child or spouse the money will pass by contract.

Your first payment may be fully taxable as income. Tax Consequences of Inherited Annuities. Taxability of Annuities for Beneficiaries.

Related

This so-called inherited annuity is the outcome. Browse Get Results Instantly. Based on whether you purchased the annuity with qualified pre-tax or nonqualified post-tax.

Surviving spouses can change the original contract. Ad Search For Info About Annuities pros and cons. Qualified annuity taxation.

This guide will explain how annuities work for beneficiaries when an annuity owner dies. When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount. From Fisher Investments 40 years managing money and helping thousands of families.

The simplest option is to take the entire amount as a lump sum. Ad See If An Annuity Is Right For You. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers.

Interest earned in a deferred annuity the most popular type is not taxed until. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. Annuities are designed to build wealth and income for your retirement through tax deferral.

Ad Annuities help you safely increase wealth avoid running out of money. Ad Learn More about How Annuities Work from Fidelity. In the case where the recipient is a surviving spouse he or she can initiate.

Dont Buy An Annuity Without Knowing The Hidden Fees. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. For example imagine you.

Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. FindInfoOnline Can Help You Find Multiples Results Within Seconds. If you have an annuity contract you can choose a beneficiary to receive the remaining payments or.

Usually a 401k or another tax-deferred. Income from annuities is taxed as ordinary income. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit.

Annuities provide guaranteed returns by participating in market gains but not the losses. For example if the owner. The proceeds from an annuity death benefit are taxable when they are received by the beneficiary.

It depends on your contributions. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. How Inherited Annuities Are Taxed.

Annuities are insurance contracts that offer unique guarantees and tax deferral and they are commonly used to save for retirement. Ad Learn More about How Annuities Work from Fidelity. Beneficiaries of Period-Certain Life Annuities.

Basically your first withdrawal is front loaded with all the gains and interest youve accumulated in your account. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Taxes at Death. In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding. When an annuity payment is made 50 of each payment would be income taxable.

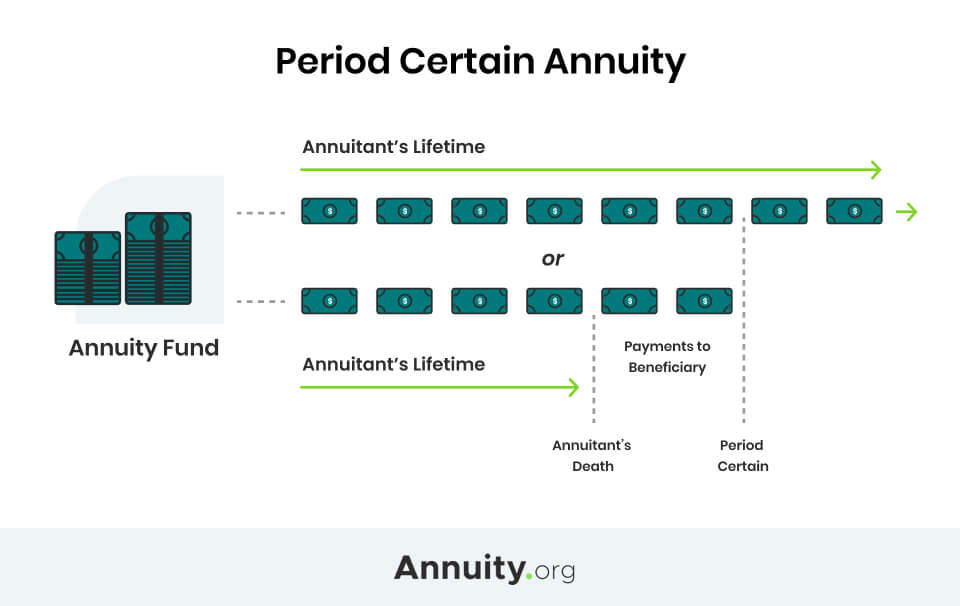

An annuity that has been funded with previously untaxed funds is considered a qualified annuity. One you might not have heard of is called an annuity stretch It gives non-spouse beneficiaries a way to receive income and defer taxes. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both.

An annuity contract provides for tax-deferred growth of the money invested and an option to turn a lump-sum amount into a guaranteed income.

How To Avoid Paying Taxes On An Inherited Annuity

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Taxation Of Annuities Ameriprise Financial

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

What Is An Annuity How Are Income Annuities Different Income Annuities For Dummies

Annuity Beneficiaries Inheriting An Annuity At Death 2022

The Taxes On The Inheritance Of A Tax Deferred Annuity

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

Financial Blog Archives Prcualife

Annuity Beneficiaries Inherited Annuities Death

Taxation Of Annuities Explained Annuity 123 Annuity 123

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Payout Options Immediate Vs Deferred Annuities

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Beneficiaries Inheriting An Annuity After Death

Period Certain Annuity What It Is Benefits And Drawbacks